Bulk Process FBR Invoices with CSV Upload Integration

Bulk CSV Upload

Upload thousands of transactions via CSV files. Our system processes bulk data, validates against FBR requirements, and generates compliant invoices automatically.

Automated Processing

Each CSV row is automatically processed through FBR APIs for tax calculations, NTN validation, and compliance checking before invoice generation.

Batch Export

Export processed invoices, tax reports, and compliance documents in bulk. Perfect for businesses handling hundreds of transactions daily.

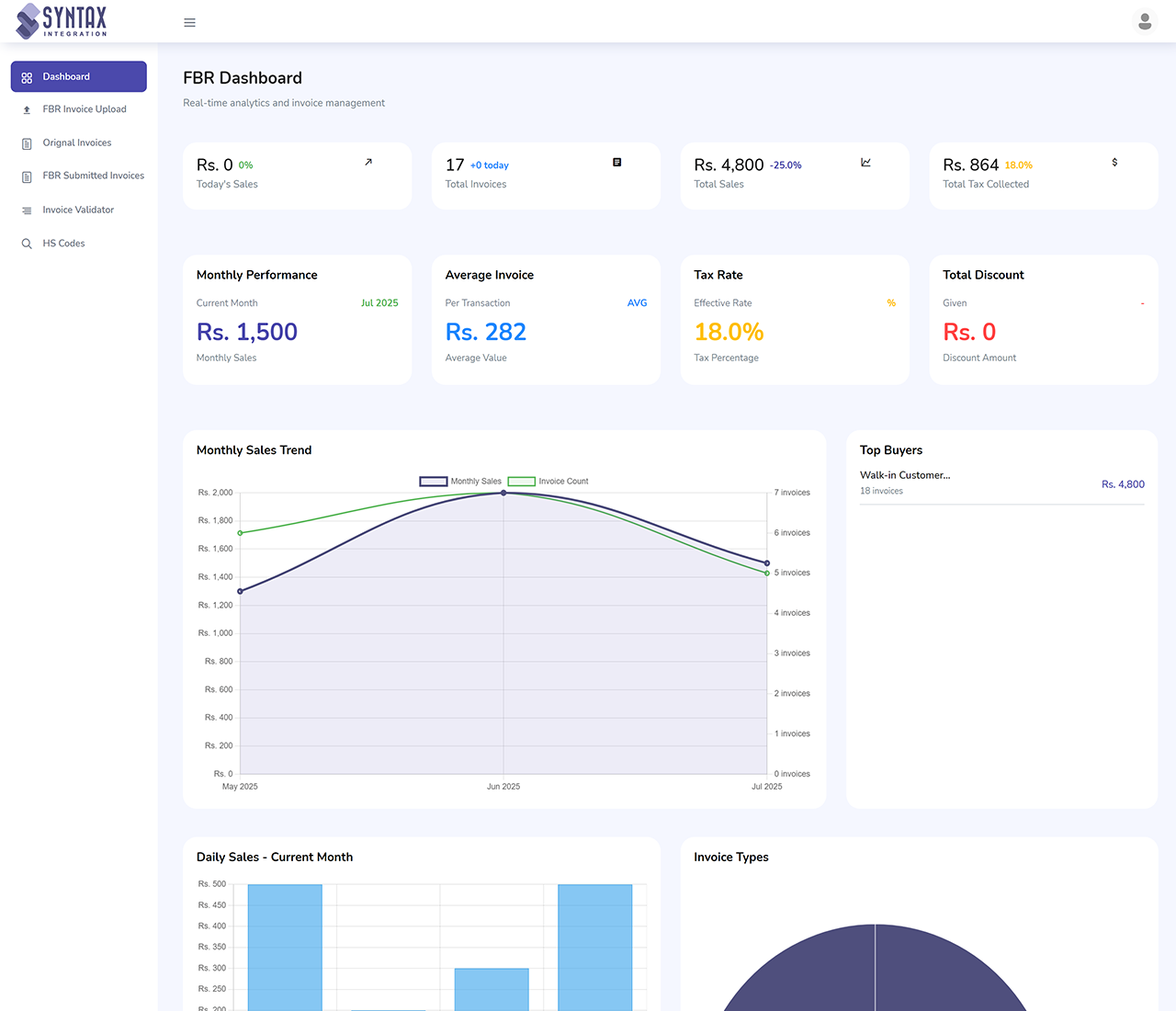

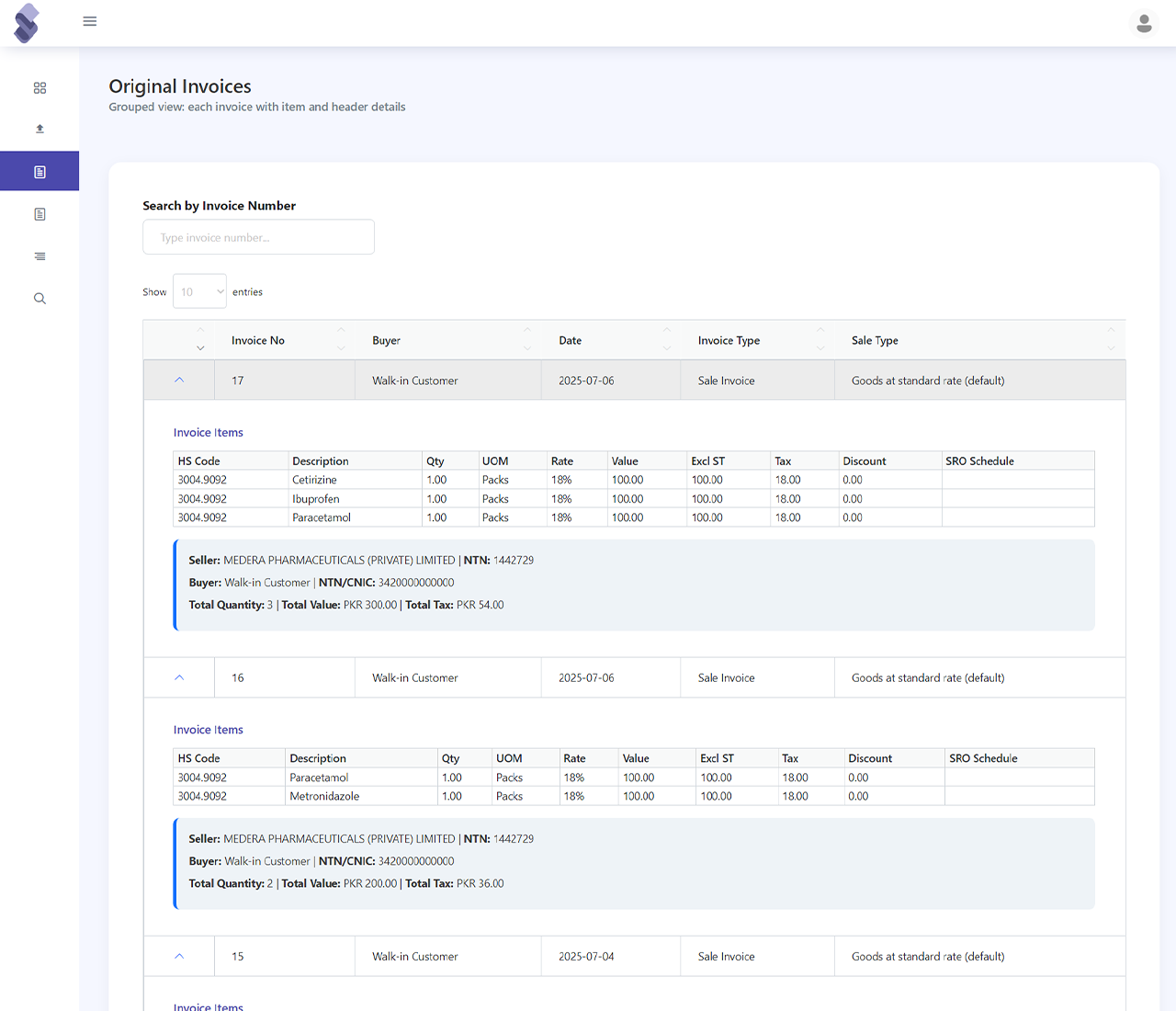

Streamline Bulk Invoice Processing with CSV Upload Technology

SYNTAX specializes in bulk transaction processing through advanced CSV upload functionality. Upload your sales data in spreadsheet format, and our system automatically processes each transaction through FBR APIs for tax calculations, compliance validation, and instant invoice generation. Handle thousands of transactions in minutes, not hours.

Smart CSV Processing Engine

Advanced CSV parser handles complex data formats, validates each row against FBR requirements, and processes thousands of transactions simultaneously with error handling.

Bulk Invoice Generation

Generate hundreds of FBR-compliant invoices from your CSV data in one click. Each invoice includes proper tax calculations, QR codes, and digital signatures automatically.

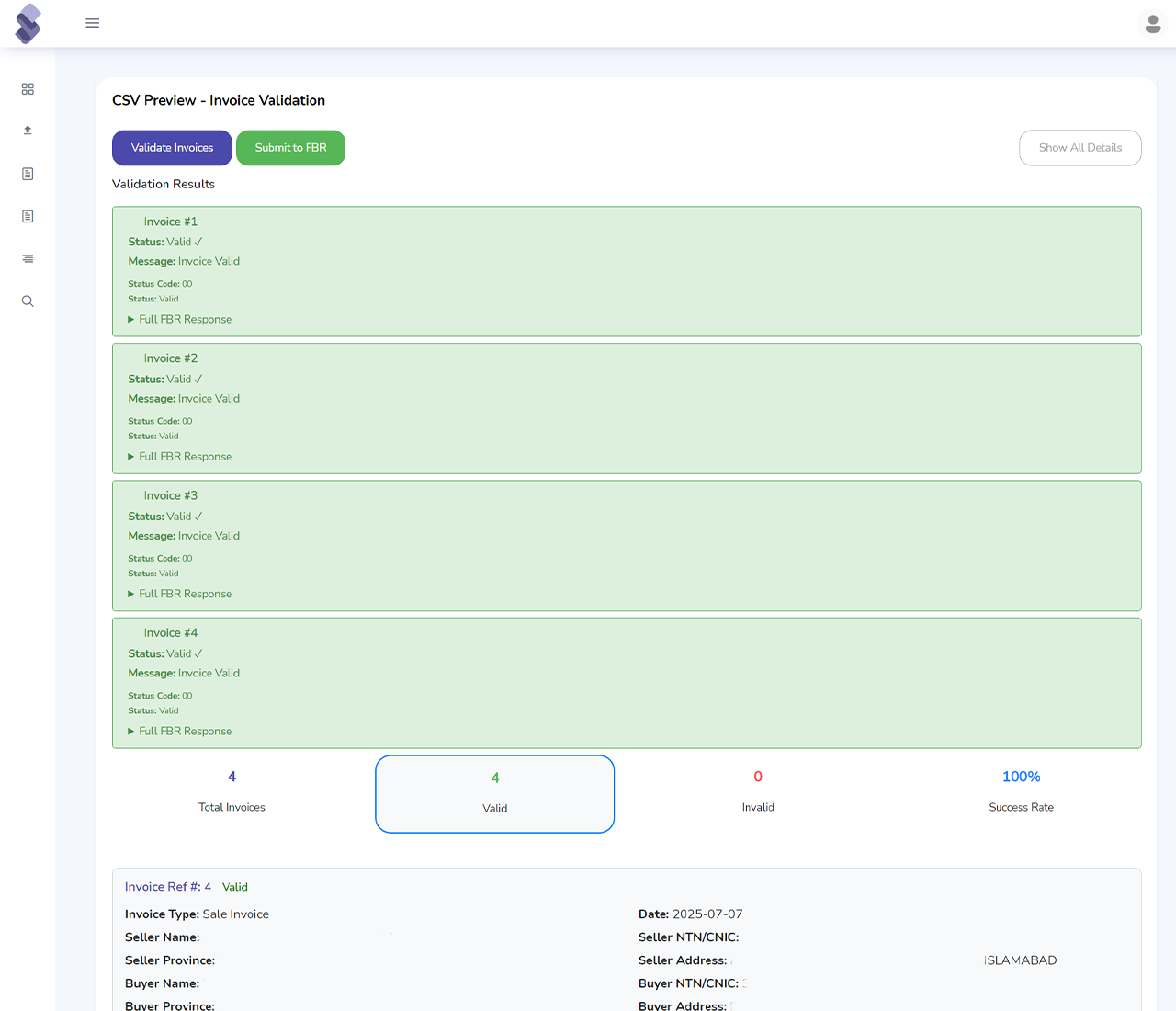

01

CSV Data Upload

Upload your sales transactions via CSV files containing customer details, product information, and transaction amounts. Our intelligent parser validates data format and prepares it for FBR processing with built-in error checking.

Smart CSV validation

Bulk data processing

Error detection & reporting

02

FBR API Processing

Each CSV row is automatically processed through FBR APIs for real-time tax calculations, NTN validation, and compliance checking. Our system handles thousands of transactions simultaneously while maintaining accuracy.

Batch FBR API calls

Real-time tax calculations

Instant compliance validation

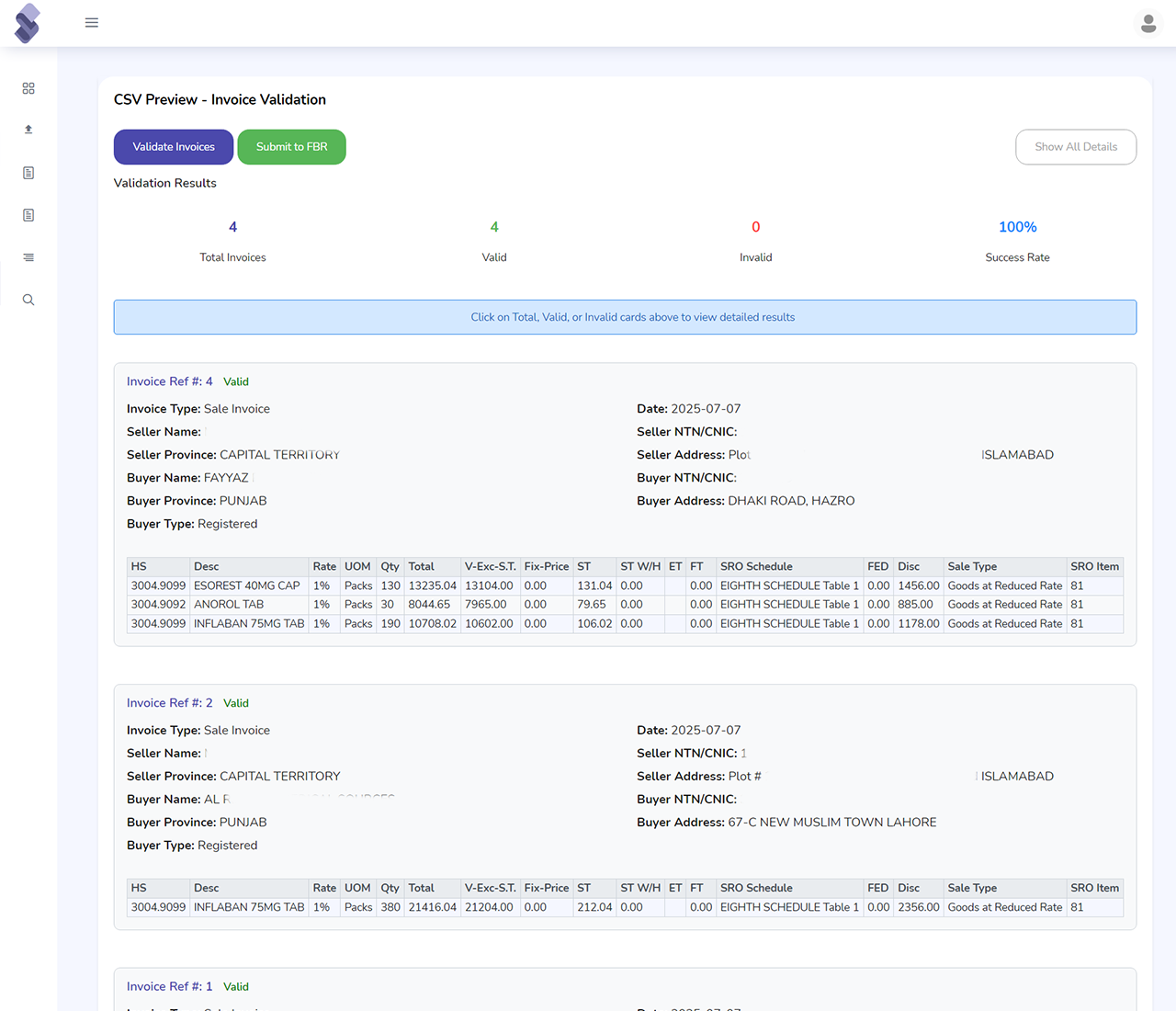

03

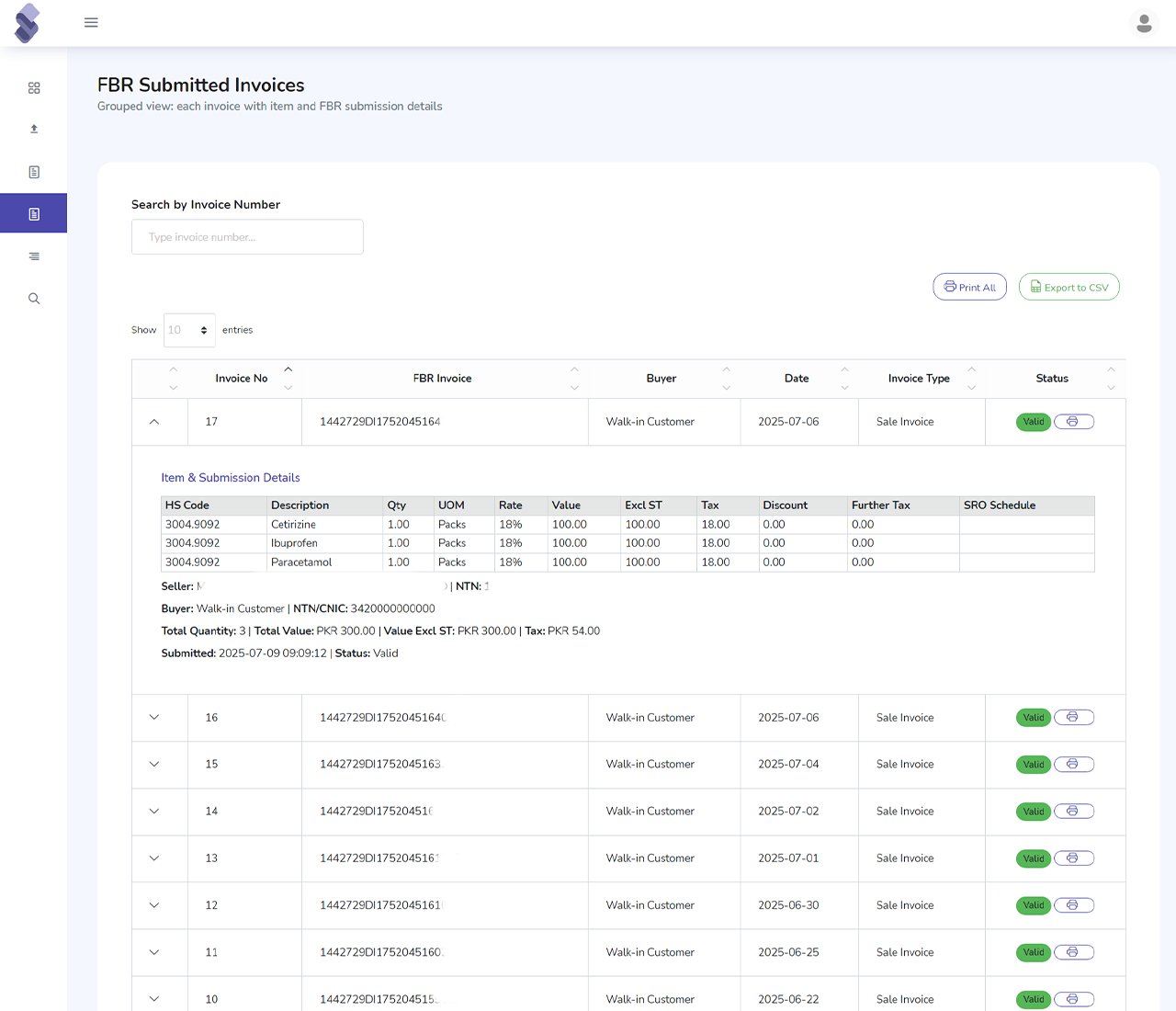

Bulk Invoice Export

Export hundreds of processed, FBR-compliant invoices in various formats. Download complete batches with tax calculations, compliance reports, and submission-ready documents for your records.

Bulk PDF generation

Multiple export formats

Batch compliance reports

Advanced CSV Processing Features

Comprehensive bulk processing tools designed specifically for high-volume Pakistani businesses. Upload, process, and export thousands of FBR-compliant invoices with advanced CSV handling capabilities.

CSV Template System

Pre-built CSV templates ensure your data uploads are structured correctly for optimal FBR processing and compliance.

Batch Processing Queue

Intelligent queue management processes large CSV files efficiently while maintaining system performance and accuracy.

Error Handling

Advanced error detection identifies and reports data issues before processing, ensuring clean FBR submissions.

Bulk Export Options

Export processed invoices, reports, and compliance documents in multiple formats for easy record-keeping.

0

Active Businesses

0

Invoices Processed

0

Compliance Rate

0

Solutions Tailored

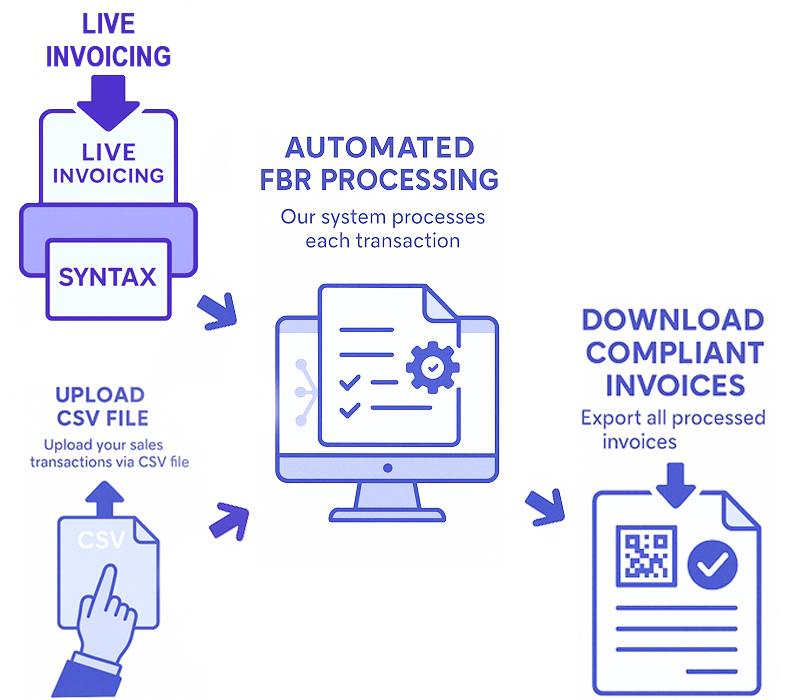

Simple Three-Step CSV Processing Workflow

Our streamlined CSV upload process is designed for businesses handling high transaction volumes. Upload your sales data, let our system process it through FBR APIs, and download compliant invoices in minutes. Perfect for distributors, wholesalers, and retail chains.

-

Upload CSV File

Upload your sales transactions via CSV file using our standardized template. Support for thousands of rows with automatic validation and error checking.

-

Automated FBR Processing

Our system processes each transaction through FBR APIs for tax calculations, NTN validation, and compliance verification in real-time batch processing.

-

Download Compliant Invoices

Export all processed invoices with proper tax calculations, QR codes, and FBR compliance certificates ready for distribution to customers.

Ready to Streamline Your FBR Compliance?

Get started with SYNTAX today and experience seamless FBR integration for your Pakistani business. Our team will help you set up automated tax compliance in just 24 hours.

Call Us

+92 300 6222822

+92 345 5759292

Email Us

syntaxali9292@gmail.com

Visit Our Office